Effective Pocket Option Trading Strategies for Success 1495531469

When it comes to trading in the binary options market, having a solid strategy is essential for success. This is particularly true for platforms like pocket option trading strategies pocketoption-new.com, which provide a wide array of tools and features designed to help traders optimize their performance. In this article, we will delve into various pocket option trading strategies that can help you achieve consistent profits while minimizing risks.

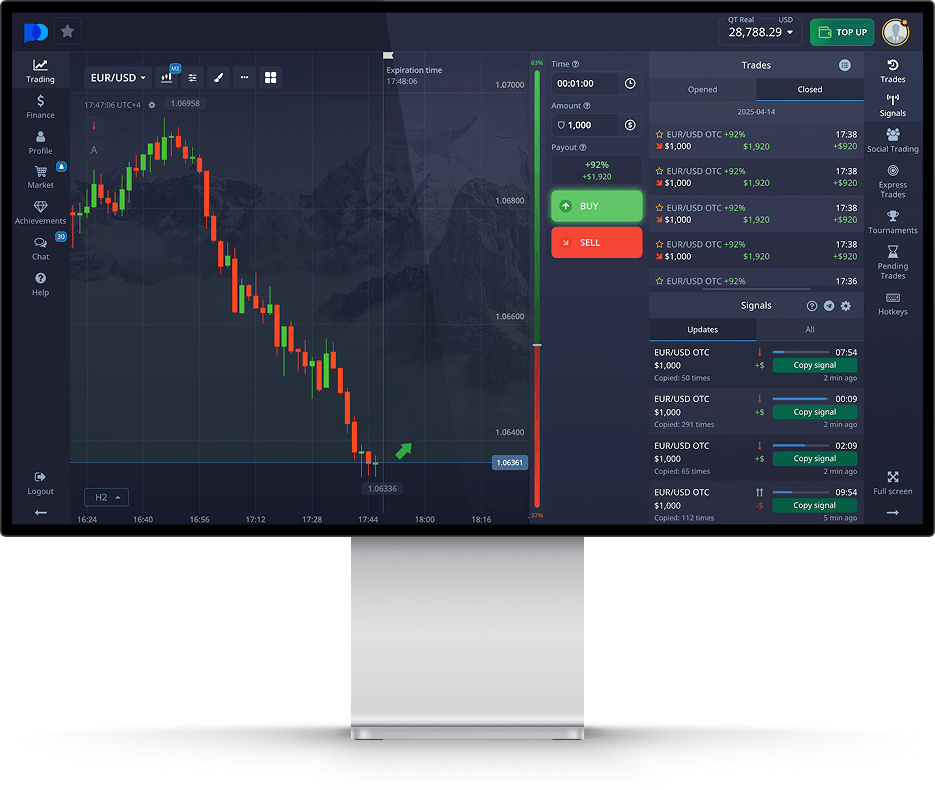

Understanding Pocket Option

Pocket Option is a popular trading platform that allows users to trade binary options on a variety of assets, including currencies, commodities, and stocks. One of the key features that attract traders to Pocket Option is its user-friendly interface, which makes it accessible to both beginners and experienced traders. Moreover, the platform offers various trading tools and indicators that can aid in the development of effective trading strategies.

Basics of Binary Options Trading

Binary options trading involves predicting the price movement of an asset over a specific period. Traders decide whether the price will rise (call option) or fall (put option), and if their predictions are correct, they earn a predetermined profit. However, if they are wrong, they lose the invested amount. Understanding how binary options work is crucial before implementing any trading strategy.

Developing Winning Trading Strategies

Creating a successful trading strategy often involves careful analysis and risk management. Below are some effective strategies that traders can utilize on Pocket Option:

1. Trend Following Strategy

The trend following strategy is one of the most popular approaches in trading. It involves analyzing price trends to make predictions about future movements. Traders can use technical indicators like Moving Averages to identify the direction of the trend. For instance, if the price of an asset is above its moving average, it indicates a bullish trend, prompting traders to consider call options.

2. Support and Resistance Levels

Identifying support and resistance levels can significantly enhance trading decisions. Support levels indicate where the price tends to stop falling and may reverse, while resistance levels indicate where the price tends to stop rising. By carefully analyzing these levels, traders can make informed predictions about potential price movements. For example, if the price approaches a strong support level, a trader may anticipate a bounce back and choose a call option.

3. News and Event Trading

Financial markets are highly sensitive to news and economic events. Traders can capitalize on this by using a news trading strategy, where they analyze scheduled news releases and their potential impact on the market. This strategy requires keeping a close eye on economic calendars and understanding how various events affect asset prices. For example, significant data releases like employment reports or central bank announcements can create volatility and trading opportunities.

4. Martingale Strategy

The Martingale strategy is a popular approach among traders looking to recover losses. It involves doubling the investment after each loss to make a profit on a winning trade. However, this strategy requires a substantial capital reserve, as consecutive losses can lead to significant drawdowns. While it can be risky, many traders find success with disciplined application.

5. Candlestick Pattern Recognition

Candlestick patterns provide valuable insights into market sentiment. Understanding and recognizing these patterns can help traders make informed decisions. Patterns such as doji, hammer, and engulfing can indicate potential reversals or continuations in price trends. Incorporating candlestick analysis into your trading strategy can enhance your predictive capabilities.

Risk Management in Trading

Regardless of the trading strategy employed, risk management is paramount. Traders should establish clear rules regarding how much capital to risk on each trade, typically no more than 1-2% of their total trading account. Additionally, employing stop-loss orders can help limit potential losses. Always remember that no strategy guarantees success, and losses are a part of trading.

Utilizing Demo Accounts

Before trading with real money, it’s advisable to practice using Pocket Option’s demo account. This allows traders to familiarize themselves with the platform’s features and test different strategies without any financial risk. A demo account can help you refine your approach and build confidence before transitioning to live trading.

Staying Informed and Educated

The financial markets are dynamic and ever-changing. To be a successful trader, it’s essential to stay informed about market conditions, economic indicators, and global events that may impact asset prices. Engaging in continuous education through articles, webinars, and trading communities can significantly enhance your skills and knowledge.

Conclusion

Developing effective pocket option trading strategies requires a combination of research, analysis, and risk management. Whether you choose a trend following strategy, leverage support and resistance levels, or utilize candlestick pattern recognition, consistency and discipline are key. Always remember to stay informed about market trends and practice your strategies in a risk-free environment, like a demo account, before committing real funds. With the right approach and mindset, you can navigate the binary options market successfully and increase your chances of achieving your financial goals.