Balance Sheet Cheat Sheet

Contents:

The owner’s equity represents a company’s net worth and is a very important variable for shareholders, current investors, and potential investors. Encumbrance recognition is particularly useful for government agencies because their primary mission is to control the flow of resources. (U.S. government officials are legally obliged to repay the money if they overcommit appropriated funds.) Encumbrance recognition is also used by organizations that have large long-term projects, such as defense contractors.

Donor-restricted net assets are those designated specifically for a purpose or a period of time. Endowment funds of cash, securities, or other assets for the maintenance of the NFP are still subject to donor stipulations. Liabilities, as with for-profit entities, are a nonprofit’s debts and financial obligations. A typical statement of financial position differentiates between “current” and “long term” liabilities, with the former category representing obligations owed within one year. Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances.

What’s so essential about a balance sheet?

Nevertheless, the recognition of encumbrances provides very useful information about the resources available. When coupled with recognition of budgeted resource inflows, encumbrance accounting permits a continuous measure of the unencumbered resources that can be freely used to accomplish the fund’s objectives. 3,000 scholarship is awarded to a student, the amount is included in tuition revenue and recorded as a transfer to an unrestricted current fund.

Similarly, if it receives few endowment gifts, its endowment principal may not grow sufficiently to generate the higher income needed in future years to keep pace with costs. Our non profit financial projection template provides up to 5 years of balance sheet, income statement and cash flow projections. Keep in mind that this report is more accurate and helpful if your organization uses an accrual method of accounting rather than the cash method. Accrual accounting allows nonprofits to record revenue when earned and expenses when incurred rather than when the money actually enters or leaves the account . It provides a more accurate statement about when financial changes occurred, creating a more exact report to work off of. The change in net assets without donor restrictions indicates if an organization operated the most recent fiscal period at a financial gain or loss.

The resulting financial statements must be interpreted differently from corporate statements. A deficit in a nonprofit enterprise may mean that it has invested in activities benefiting future generations. The nonprofit organization tries to make a match; the generation that gets the benefits also pays for them through future tax payments. The deficit is not necessarily a signal of failure or a cause for concern, as it is in a business. In addition, the statement of changes in fund balances documents the mix of funds received, a critical factor in the institution’s long-term financial mobility. If, for example, the institution attracts mostly restricted gifts, with few endowment or unrestricted gifts, its operating funds may eventually suffer.

Accounting for budgeted versus actual events offers a useful measure of how well management has carried out its plans. Accounting for accruals and encumbrances is useful for tracking the availability of resources for specified purposes. These questions must be answered in light of what the trustees construe as the institution’s future ability to generate gifts for major additions. For each fund listed in Exhibit III, we shall examine the information that can be gleaned from the statement and suggest questions it should raise for any alert trustees reviewing it.

Steps in preparing Balance Sheet:

The result is the number of months that you can cover with the liquid assets you have on hand. Propel Nonprofits strengthens the community by investing capital and expertise in nonprofits. Propel Nonprofits is also a leader in the nonprofit sector, with research and reports on issues and topics that impact that sustainability and effectiveness of nonprofit organizations. At Smith and Howard, our nonprofit accounting professionals have extensive experience preparing financial statements for nonprofit organizations, and can also provide support with audit, tax, and other accounting requirements.

- Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances.

- GrowthForce accounting services provided through an alliance with SK CPA, PLLC.

- At the same time, private nonprofits, increasingly dependent on the financial markets for capital funds, must obtain and maintain satisfactory credit and bond ratings in order to get these funds.

- Accountants must assume that their readers can account—that is, they are educated in this discipline.

This line is a direct connection with and should be equal to the bottom line of an organization’s income statement (also called a Statement of Activities or profit/loss statement). Recognizing net assets with donor restrictions and representing them as such in financial statements is crucial so that organizational decision-makers are aware of obligations in the future. For those in a senior leadership role at a nonprofit, it’s important to acknowledge that these accounting statements tell a story. Those who read the statements use them to assess the performance of the nonprofit and ensure donor funds are wisely spent. Each statement, and any accompanying disclosures, convey all kinds of information, from the liquidity of the organization to the effectiveness of the fundraising team. Understanding the purpose, scope, and intricacies of each type of nonprofit accounting statement is key to success.

Board Booklet

It can also be used to help spot potential or current financial concerns. Leaders, administrators, new board members; decision-making program staff; CEOs and executive directors without a formal finance background from a range of types of nonprofits. Defining whether an expense is a program or support expense is rarely a black and white issue. Allocating these costs proportionally demands the expertise of specialized nonprofit accounting professionals. A comprehensive glossary of financial terms for nonprofits can be found at nonprofitfinancefund.org/financial-terms. It is, however, important for the leadership of cultural organizations and program officers at foundations to be conversant about capital needs, and how they will be prioritized so they can be addressed over time.

Fed: Projections for banks’ overall profits to see decline through 2024 – Arkansas Online

Fed: Projections for banks’ overall profits to see decline through 2024.

Posted: Sun, 16 Apr 2023 07:58:41 GMT [source]

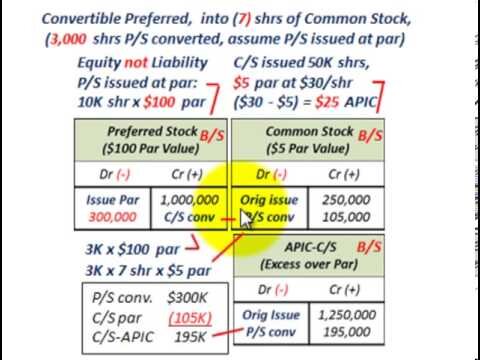

That necessary condition is not fulfilled by many corporate executives, let alone by the grandmothers of the world.11 While that fact is regrettable, it will not be changed by oversimplification of accountants’ reports. 530,000 is not equivalent to the net increase in a corporation’s equity. Information about the sources of the funds is needed to evaluate Pepys’s financial management. The assumption of an obligation, noted during the fiscal period in which the encumbrance is acknowledged, is merely the first step in the process that, at some later point, will result in an actual expenditure.

Example of Main Difference Between Nonprofit and For-Profit Balance Sheets

Like a balance sheet, the SOP shows the organization’s assets and liabilities. The main difference is that in an SOP, what is left after you subtract the liabilities from the assets is called the net assets. Net assets represent the nonprofit’s net worth and are divided into three categories – unrestricted, temporarily restricted, and permanently restricted. Fund accounting was developed to present fairly the financial transactions unique to nonprofit organizations.

The Balance Sheet shows the value of assets, liabilities, and capital funds at the end of the accounting year of the organisation on a particular date. It is prepared at the end of the accounting year after preparing the Income and Expenditure Account. An organization can use unrestricted net assets for general purposes, such as funding operational expenses.

I will focus on making observations about the numbers you see and employing two key ratios. To reinforce your learning, I encourage you to use a balance sheet from one of your grantees as you read. A municipality’s statement of revenues, expenditures, and encumbrances reports operating encumbrances. It enables management to track resources, just as an internal project manager in a corporation tracks the budgeted costs of a program against actual costs. In Exhibit IV, funds are comparable to the individual projects in a project monitoring system.

Much like the statement of financial position, the statement of activities must distinguish restricted funds from unrestricted funds. It should also break out distinct categories of revenue and expenses. Common revenue categories include earned revenue and donor contributions, while expenses are typically split into program and non-program expenses.

They have a board-designated reserve ($50,000 at FYE ’08 and ’09 — an audit note might tell us whether there are any parameters for use of the reserve). H. David Sherman () is a professor of accounting at Northeastern University’s D’Amore-McKim School of Business and a former fellow at the SEC Division of Corporate Finance. He is a coauthor of “Tread Lightly Through These Accounting Minefields” (HBR July–August 2001).

Members of NEPM’s community advisory board resign, citing missteps on diversity – MassLive.com

Members of NEPM’s community advisory board resign, citing missteps on diversity.

Posted: Fri, 14 Apr 2023 12:12:00 GMT [source]

The appropriate measure of their performance is the level of benefits achieved, not revenues. Although our society clearly profits from education of our children, it is impossible to put an objective value on that education. So such benefits are not included in the accounting statements of nonprofit organizations.

There is good reason to believe that the reader of a corporate financial statement could benefit from having access to the same kind of information. Indeed, some aspects of fund accounting already appear in business accounting; FASB Statement 14, on reporting for segments of a business enterprise, is an example. Just as segments of restricted and unrestricted funds must be reported to permit evaluation of the management of these funds, the segments of a business need to be identified with respect to performance and assets.

Why Do Balance Sheets Matter?

Take our 2-minute survey to find out if outsourced truckers bookkeeping service and bookkeeping is a good fit for your organization. Your team needs to spend countless hours entering receipts, invoicing clients, running payroll, and reconciling your books BEFORE you can get the reports you need to run your business the right way. It’s the accumulation of all the surpluses of revenue over expenses that you’ve seen on your Statement of Activities since the start of your organization. Assets are anything of value your organization possesses or is entitled to, such as cash, pledged donations, property, equipment, investments, etc. Includes loans made under home equity lines of credit and home equity loans secured by junior liens (table L.218, line 23).

The statement of cash flows contains information about the flows of cash into and out of a nonprofit; in particular, it shows the extent of those nonprofit activities that generate and use cash. In a nonprofit organization, the statement of activities is used in lieu of an income statement. Includes cash accounts at brokers and dealers and syndicated loans to nonfinancial corporate business by nonprofits and domestic hedge funds. In addition to reserves, cultural nonprofits and their supporters seek to establish durable institutions. Typically this is accomplished through the purchase of property and the formation of endowments.

First, all nonprofits present financial statements for each group of funds, which are independent and self-balancing accounting entities within the structure. Generally a nonprofit organization has four fund groups and presents 3 financial statements per group, or 12 in all. Supposedly this creates information overload, and therefore aggregation of the funds into a consolidated set of statements would solve the problem. By generating a statement of financial position that covers all of the above, a nonprofit bookkeeper or accountant can easily determine their organization’s current performance.

So for each group of funds of similar purpose and of material size, the statement reflects revenues flowing in, expenditures, and transfers of capital among funds. The statement enables management and the trustees to track resources. Substantial transfers out of the plant and endowment funds into the current funds may indicate fiscal stress. For operational purposes the organization is cannibalizing funds that were set aside to maintain or extend its capital base. Discretionary transfers may also be made to carry out the board’s strategy.

While businesses, of course, earn most of their operating revenues from the sale of their goods or services, nonprofits must rely on nonrevenue sources, such as gifts, endowment income, and donated services and goods. Moreover, as we indicated, revenue sources frequently have constraints placed on them. For example, a portion of a hospital’s revenues for services delivered often must be used to fund a plant replacement reserve.

The statement of financial position serves a similar purpose to the balance sheet of a for-profit organization. The statement lists the assets and liabilities of the nonprofit and shows the net assets of the organization. Be careful not to apply one-size-fits-all criteria with respect to financial health. The challenge with many financial ratios is that setting specific fieldwide targets (e.g., a minimum of three months of cash) may not work well for organizations in all artistic disciplines and geographic regions. The variability of organizations and the relative youth of the nonprofit field currently lend themselves to broad guidelines, rather than prescribed expectations. As we progress in efforts to educate ourselves about the financial underpinnings of nonprofit cultural organizations, it is likely that we will be able to move toward establishing meaningful benchmarks.

Cash flows from financing activities could also include cash received to support a capital campaign. Ideally, approximately 70% or more of expenses should be program expenses. These are expenses such as research and education that directly support the mission of the nonprofit.